Cryptocurrency Cost Basis

Your ETH cost basis is now 10000 and after selling. The amount of crypto being sold and bought is the same so the cost-basis is simply 100 USD.

Crypto Advice Update Advice Bitcoin Crypto Trading

Example of Fees when Purchasing Cryptocurrency If a taxpayer buys 10000 worth of Bitcoin and pays 500 in fees then the IRS allows you to report a cost basis of 10500.

Cryptocurrency cost basis. Or more specifically all costs incurred in the acquisition of the asset. You made 1000 and are going to get taxed on that gain. Fair market value of your remaining cryptocurrency 0.

Basis means cost. However the IRS new guidance specifically allows for only two cost basis. 200 includes transaction fees Price of Bitcoin at exchange.

Instead suppose you bought 1 BTC for 1000 which appreciates in value to 10000 and then trade it for 10 ETH and then the price of that ETH crashes to 100. There is no standard guidance from the IRS on how to apply your cost basis to individual sales or exchanges of bitcoin ethereum and other cryptocurrencies. The capital gains are calculated in the same way as FIFOACB.

After much anticipation the IRS issued guidance on acceptable cost basis methods for calculating gainslosses on cryptocurrency. Using LIFO our cost basis or original purchase price of the 5 ETH that we sold off in June would be 2800 600 600 600 500 500. However you must add the selling fee of 10 so the final cost-basis becomes 100 10 110 USD.

Cost basis includes purchase price plus all other costs. That means you can add to your basis any fees or other charges associated with the acquisition. Prior to the IRS guidance there were numerous potential cost basis assignment methods taxpayers could choose from such as First in First Out FIFO Last in First Out LIFO Highest Cost Lowest Cost Average Cost and Specific Identification.

These are used in the calculation to know if the capital is a gain or loss. They will give you a summary of all your crypto purchases and sales along with the cost basis and capital gains. All cryptocurrency transactions are taxable events.

Cryptocurrency Cost Basis For digital currency brokers exchanges and related service providers seeking a reputable crypto tax solution to enhance client experiences and prepare for ever-increasing regulatory scrutiny Silver delivers the full range of cost basis processing using its modern 247 real-time Silver Cost Basis solution. Adjusting for fees allows a lesser realized taxable gain. Cost basis accounting revolves around deciding the methodology to use for determining what the cost basis of an asset should be when you make a sale.

Thus exchange calculations will have to be made to determine the basis in the newly acquired cryptocurrency. For crypto assets the cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Taxable Gain on Sale.

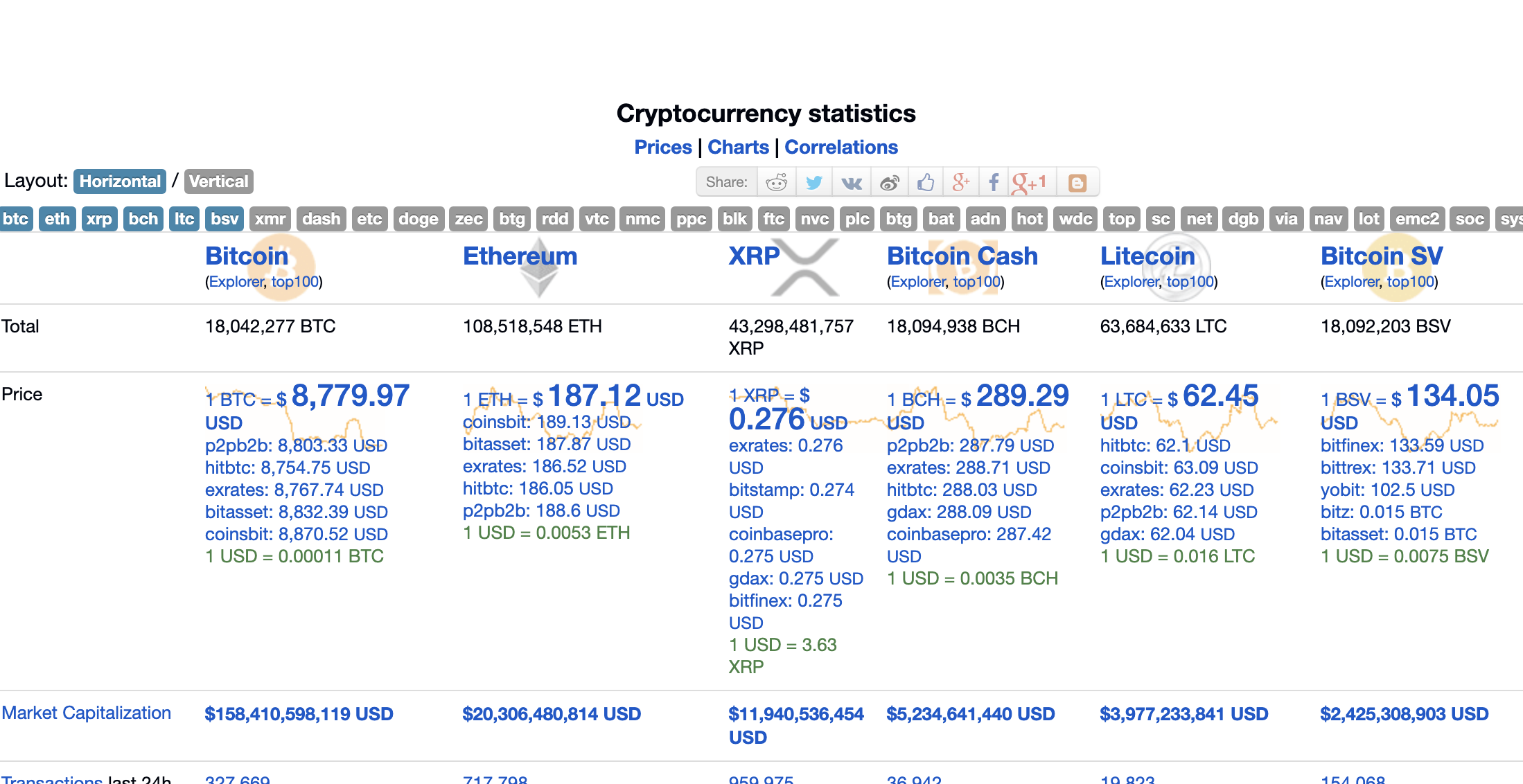

Enter the appropriate daily price for each cryptocurrency. For cryptocurrency users this can be very hard to keep track of. The cost basis of an asset is its original value which is typically the price that you paid to acquire it or the assets value when you exchanged something else for it.

Crypto cost basis is the accumulated fair market value of the currency you have plus the profits of your assets at the time they are sold. Coinbase uses a FIFO first in first out method for your Cost Basis tax report. For example lets say you used Coinbase to make your crypto purchase and paid a fee of 30 to buy that 2000 of Bitcoin.

In the case of cryptocurrency this is typically the sale price in USD terms. Cost Basis represents how much money you put into purchasing your property ie. In my case I downloaded the history for the previous year.

Doing the math then. This is column F. Basis in Ripple after Exchange.

3000 selling price - 2800 purchase price or cost basis 200 capital gain. Cryptocurrency taxes made easy. Cost basis is the original value of an asset or essentially how much money you put in to acquire that asset.

The reports you can generate on Coinbase calculate the cost basis for you inclusive of any Coinbase fees you paid for each transaction. We scan the blockchain to automatically find all of your transactions. Click on the orange down arrow to get nice cryptocurrency history.

Your basis is the cost in dollars that you actually paid for crypto when you purchased it adjusted for any related costs. For example according to CoinMarketCap historical data 1 BTC could be exchanged for between 6817 and 7135 on April 2 2018. Example of Fees when Selling Cryptocurrency.

Then for each of the eighteen entries in the spreadsheet I looked in the price history and entered the appropriate closing price in each corresponding row. Today we launch the industrys first automated and accurate cost basis tool to help investors and businesses to calculate cryptocurrency gains and lossesIt. Basis in Bitcoin after Exchange.

How much it cost you.

Purchasesharesonline Ionelui Who Knows Whatwill Be Estimated Cost Coin Collec History Design Coin Collectors Bitcoin Generator

Ethereum Ethereum Decentralized Banking Map From Users Perspective Banking Bitcoin Asset Management

What Is The Difference Between Net Fiat Invested And Cost Basis Investing Fiat Money Fiat

Pin On Cryptocurrency Development Solutions

How A Bitcoin Transaction Actually Works Bitcoin Transaction What Is Bitcoin Mining Bitcoin Infographic

Bitcoin Vs Gold Bitcoin Bitcoin Price Crypto Trading

24 Fun Bitcoin Facts Stats And Figures That Will Make Your Head Spin Infographic Bitcoin Infographic Bitcoin Infographic

Cryptocurrency Development Services Cryptocurrency Software Development Company Developcoins Cryptocurrency Online Business Marketing Crypto Coin

Bitcoin S 6 000 Cost Basis Suggests It S Macro Bullish Despite 50 Decline From Highs Bitcoin Bear Market Currency Market

Pin By Bbod Trading On Hi Tech Blockchain Cryptocurrency Bitcoin Blockchain

Fiat Vs Bitcoin Bitcoin Bitcoin Business Fiat

This Tool Has Called Nearly Every Bitcoin Top And It Just Triggered Again Bitcoin What Is Marketing Stock Market

How Can We Make These Transaction Costs Lower Please I Want To Know Why Are More Institutions Networking Their Buy Cryptocurrency Transaction Cost Bitcoin

Cryptocurrency Mining Calculators For Wordpress Bitcoin Mining Bitcoin Cryptocurrency Cryptocurrency

Mcafees Prediction Only 365 Days Left Bitcoin Trades 95 Below Dickline Projection Bitcoin Predictions Bitcoin Price

Bitinfocharts Price Chart Bitcoin Capital Market

How To Determine The Blockchain App Development Cost Blockchain Link And Learn App Development Cost