Cost Basis Report Cryptocurrency Example

Diligent record keeping while difficult and time-consuming will translate to real world dollars saved when it comes time to file. That means you can add to your basis any fees or other charges associated with the acquisition.

How To Report Cryptocurrency On Taxes Tokentax

Cost basis accounting can be complicated and incredibly cumbersome to manage as we engage with dozens of exchanges and different wallets.

Cost basis report cryptocurrency example. For example according to CoinMarketCap historical data 1 BTC could be exchanged for between 6817 and 7135 on April 2 2018. For example lets say you used Coinbase to make your crypto purchase and paid a fee of 30 to buy that 2000 of Bitcoin. Proceeds - Cost Basis Capital GainLoss.

You will only be taxed on the gains. This includes purchases in fiat currency or another crypto. Doing the math then.

By doing so youll arrive at the new per-share cost basis 100002000500. 3000 selling price - 2800 purchase price or cost basis 200 capital gain. Then write in one row on Form 8949 containing the total capital gains a Continue reading.

There is also a 15 fee. Having calculated the cost basis. In this example your cost basis or the cost at which you bought your cryptocurrency is 1000 x 1015 2 or 50750 per coin.

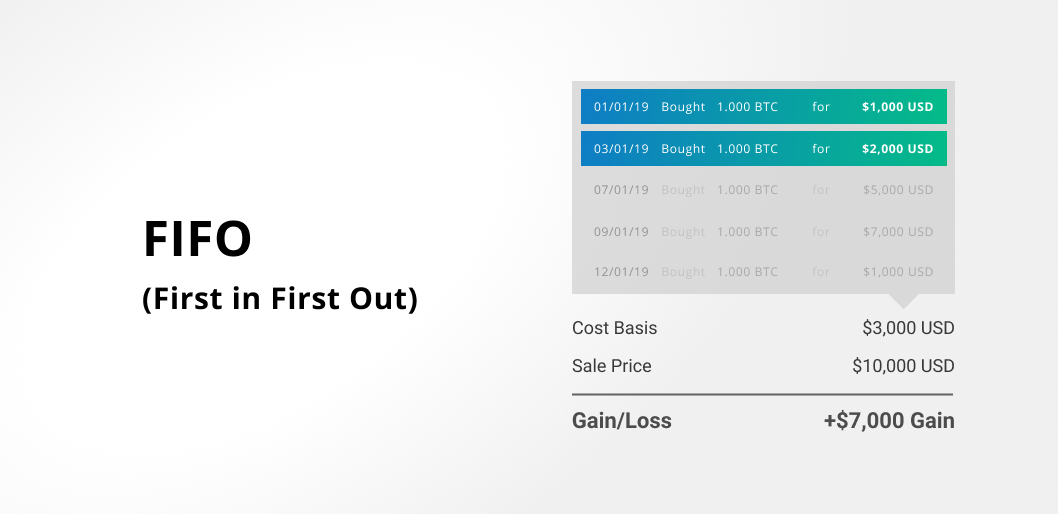

There are two simple ways to calculate crypto cost basis heres an example. CryptoTraderTax was developed and launched by the Coin Ledger team in 2017. Cost basis purchase price exchange fees BTC holdings 3000 15x3000 1 3045 per BTC.

To illustrate this further lets use the exact same example from above. For example if you purchased 4 Litecoin for 25830 and later sold the 4 Litecoin for 97755 then you will realize a gain of 71925. Your capital gainslosses are determined by the difference between the cost basis and the price you sell your capital asset.

Your cost basis is the gross USD value at which you acquired the crypto being sold exchanged or spent. Simply put your cost basis is what you paid for an investment including brokerage fees. The IRS treatment of cryptocurrency as investment property means that your cost basis will change with each exchange that you make.

This can be a spreadsheet. To determine the gains and losses to report taxpayers must subtract their cost basis from their proceeds. Thus exchange calculations will have to be made to determine the basis in the newly acquired cryptocurrency.

Cost basis purchase price exchange fees BTC holdings 3000 15x3000 1 3045 per BTC. Since your cost basis was 50750 your capital gains is 24250. A few months later you decide to sell 1 Ethereum at 750 per coin.

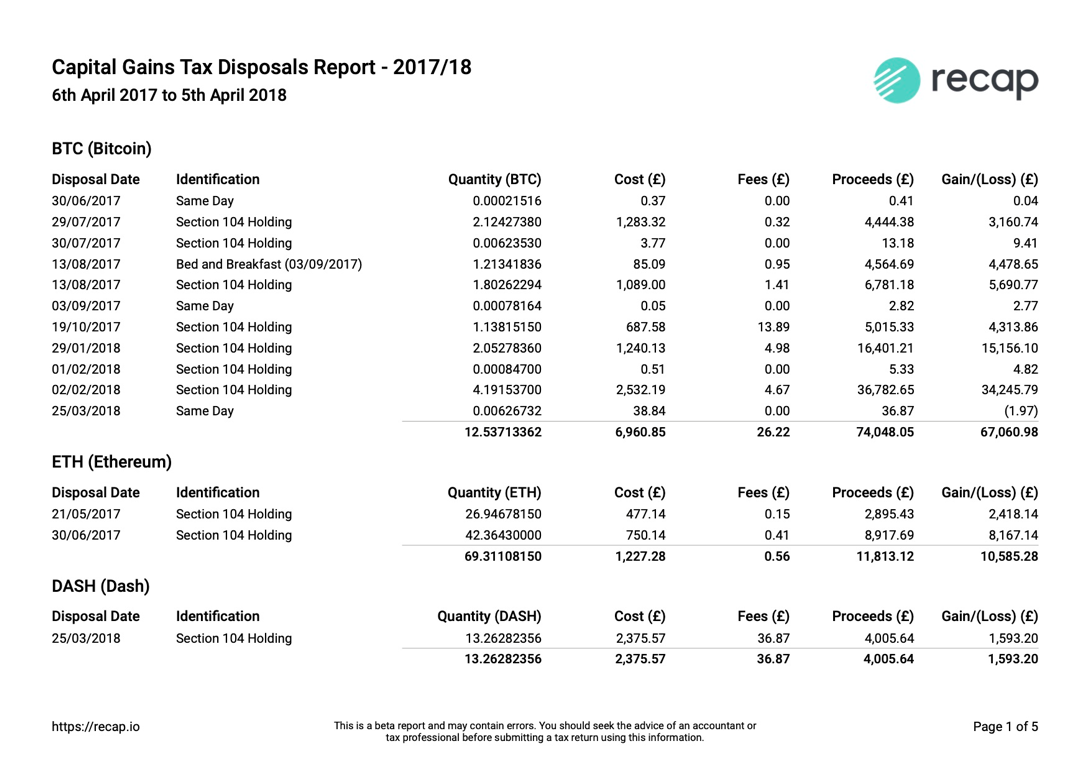

Calculate the cost basis and capital gains of every taxable crypto transaction you made in 2017 and attach it as a separate statement to Schedule D Form 8949. Using LIFO our cost basis or original purchase price of the 5 ETH that we sold off in June would be 2800 600 600 600 500 500. Typically you will not have any adjustments but the IRS lists capital gain adjustments in their instructions if you need them.

Calculate your crypto by taking the initial investment amount say 10000 and divide it with a new number of shares that you hold say 2000 shares. Wwwcointrackerio is one example and currently allows multiple cost basis models reads your coinbase crypto exchange account via API to track your gainloss performance over time using the prices at any given time for costvalue including the fees at that given time. This code describes the adjustment amount you enter in column G.

Diligent record keeping while difficult and time-consuming will translate to real world dollars saved when it. 97755 - 25830 71925. The IRS treatment of cryptocurrency as investment property means that your cost basis will change with each exchange that you make.

Basis means cost. The IRS requires taxpayers to report their cost basis and proceeds when they trade or sell capital assets such as Bitcoin. Cost basis accounting can be complicated and incredibly cumbersome to manage as we engage with dozens of exchanges and different wallets.

In this example John is disposing of his Bitcoin by trading it for ETH. Or more specifically all costs incurred in the acquisition of the asset. Johns cost basis for the 05 Bitcoin that he traded was 5000 0510000.

This incurs a taxable event and John realizes a capital gain or capital loss. Cointrackerio charges you to generate the tax reports. Adjustment if any to gain or loss.

CryptoTraderTax is a leading cryptocurrency tax reporting platform used by individual crypto investors accountants and crypto exchanges to enable cost basis tracking capital gains and losses reporting and streamlined tax processes.

Difference Between 1099 K And 1099 B Tax Forms From Cryptocurrency Exchanges Taxbit Blog

Understanding Irs 8949 Cryptocurrency Tax Form Taxbit Blog

Bitcoin Vs Gold Bitcoin Bitcoin Price Crypto Trading

Understanding Irs 8949 Cryptocurrency Tax Form Taxbit Blog

Onecoin Http Tanyavega Com Onecoin One Coin Digital Currency Coins

Cash Basis To Accrual Basis Conversion Example Showing Actual Calculations Required Spreadsheet Template Business Financial Plan Template Worksheet Template

Five Solid Evidences Attending Economies Of Scale Example Is Good For Your Career Development Economies Of Scal Economies Of Scale Economy Career Development

Foursquare Business Model Canvas Business Model Canvas Model Canvas Business Model Canvas Examples

Progressive Insurance Business Model Canvas In 2021 Business Model Canvas Business Insurance Model Canvas

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

A Complete 2020 Guide To Cryptocurrency Taxes Taxbit

How To Report Cryptocurrency On Taxes Tokentax

Sample Entry Level International Trade Resume Examples Resume Cv Resume Examples Resume Business Resume

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

A Complete 2020 Guide To Cryptocurrency Taxes Taxbit

Dental Invoice Spreadsheets Presented Us The Prospective To Input Modify And Estimate Anyth

Conditional Value At Risk Cvar Excel Budget Education Pictures Excel

Maisbot 2018 Multi Faucets Automatically Claims Crypto Currencies Get It What Is Bitcoin Bitcoin Digital Payment

The Worst Has Been Priced In Theo Trade Bear Market Bad Stock Market