Can You Declare Capital Loss On Cryptocurrency

This means that when you realize losses after trading selling or otherwise disposing of your crypto your losses get deducted from other capital gains as well as ordinary income up to 3000. Even if the market value of your cryptocurrency changes you do not make a capital gain or loss until you dispose of it.

Guide To Declaring Crypto Taxes In Sweden

If you sell cryptocurrency for less than the amount that you paid for it this is considered to be a capital loss.

Can you declare capital loss on cryptocurrency. This example assumes that the cryptocurrency in question was held as an investment on account of capital. This is different than some of the losses we discuss below. If you accept cryptocurrency as payment for goods or services you are subject to the barter rules.

Additionally if you dont receive the cryptocurrency you pay for you may not be able to claim a capital loss. How much tax do I pay on crypto gains. In this guide well explore exactly what tax benefits crypto losses can provide.

If you dont have any capital gains to offset with your cryptocurrency losses you can deduct up to 3000 per year from your ordinary income. However if you pay for and receive cryptocurrency you might be able to make a negligible value claim if it subsequently turns out to be worthless. Should crypto investors purposefully avoid reporting their capital gains and losses the IRS can enforce a number of penalties including criminal prosecution which is only used in the most.

So you work out if youve made a capital gain or loss on each transaction then add these amounts together to calculate your total capital gain or loss. You should record your income at the fair market value of the cryptocurrency at the time you receive the payment. You can use crypto losses to either offset capital losses including future capital losses if applicable or to deduct up to 3k from your income.

One small silver-lining is that if you have a loss on an investment you can reduce your tax bill. To help you complete your tax return take a look at the 2021 CGT guide and let us know if you have further questions. In this context the issue is likely to be whether the cryptocurrency is lost whether you have lost evidence of your ownership or whether you have lost access to the cryptocurrency.

The amount of tax you pay on crypto gains depends on how long you held the asset for. Check if you need to pay tax when you receive cryptoassets. If when combined total capital gains for the year is a net negative number up to 3000 of those losses can be used as.

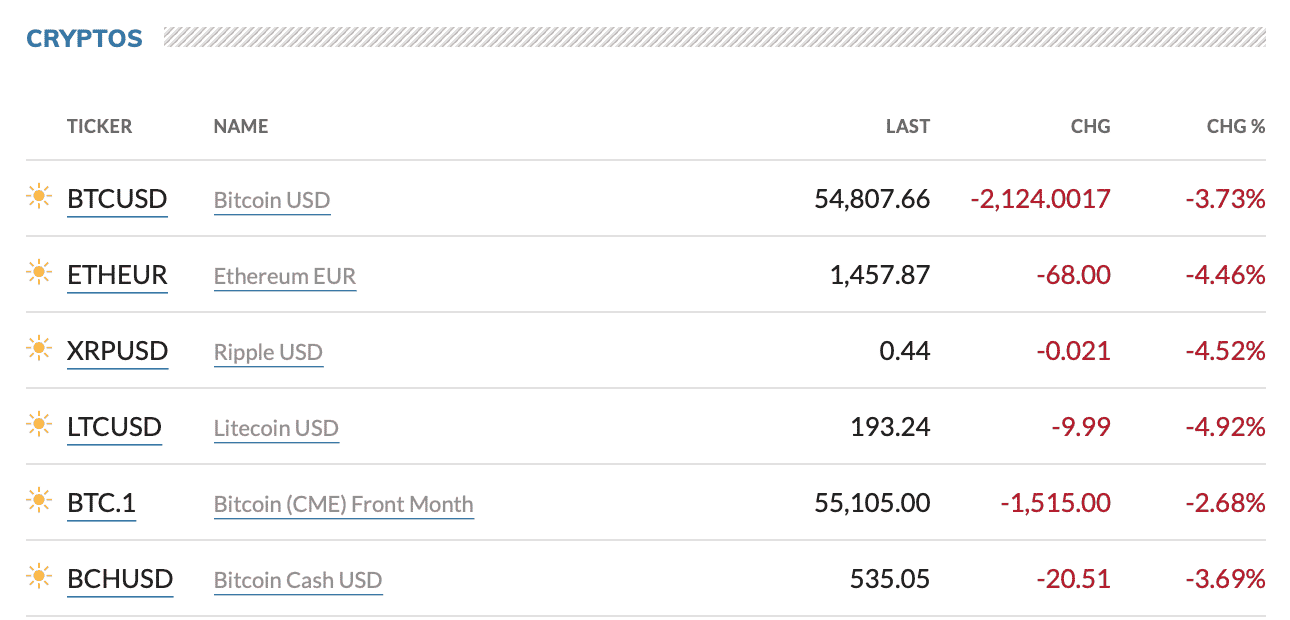

At this point its simply a matter of aggregating those cryptocurrency losses with other capital gains and losses from 2018 eg from any other stock bond mutual fund ETF or other investment property transactions. Capital gains tax is based on each disposal. When declaring your cryptocurrency the biggest question you need to ask if it is the nature of revenue or capital.

Changes to the annual exempt amount for Capital Gains Tax. Yes cryptocurrency losses are tax deductible. For more detailed information please read our guide on how to deal with capital losses for your cryptocurrency.

Any income received or accrued from cryptocurrencies are taxable because SARS sees cryptocurrencies as intangible assets. If you are a GSTHST registrant you need to collect and remit GSTHST in the same way as if you were being paid in cash. Last March the IRS in their Notice 2014-21 confirmed that crypto-currencies were to be taxed as property which means that whilst any profits you make from selling crypto-coins are taxed as capital gains so are losses.

Are crypto capital losses tax deductible. As most of us know by now cryptocurrency is not real but virtual money. However if you hold your cryptocurrency as an investment for 12 months or more you may be entitled to the CGT discount to reduce a capital gain you make when you dispose of it.

Note - if your cryptocurrency simply went down in price prior to selling it this is considered a capital loss or an investment loss. If you go ahead and sell your BitcoinEthereum and realise the 1000 loss then you can offset this against your 800 capital gain on the shares. You have to sell or buy an asset to trigger a taxable gain or loss.

When filing your tax return you have a few options if you have a loss. The remaining 200 capital loss is NOT included as a tax deduction on your income but instead is carried forward into following years until you do make a capital gain at which point it will offset it. However if this transaction occurred in the course of conducting a business the entire amount of 5600 would need to be reported as income in the first transaction and the entire 4400 would be reported as a loss in the second transaction.

Once you decide to make a move tax authorities consider the loss to be realized. You may be able to claim a capital loss if you lose your cryptocurrency private key or your cryptocurrency is stolen. Cryptocurrencies such as bitcoin are treated as property by the IRS and they are subject to capital gains and losses rules.

Cryptocurrency Tax Compliance Cryptocurrency Tax Attorney

Did You Report Your Cryptocurrency Investing In 2018

Bitcoin Taxation In The Developed Countries No More Tax

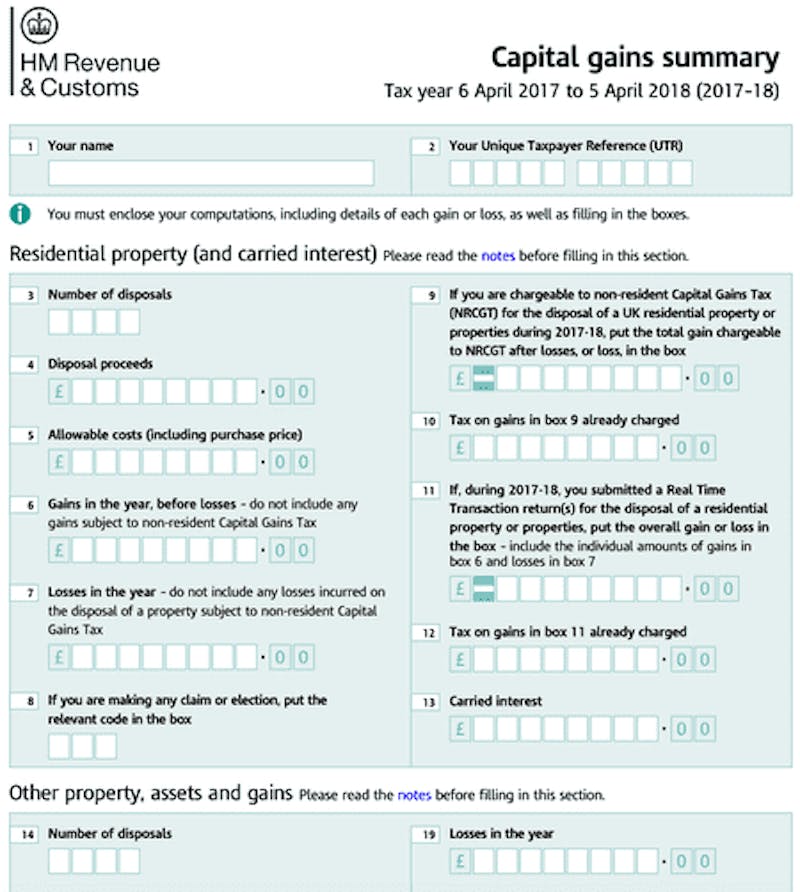

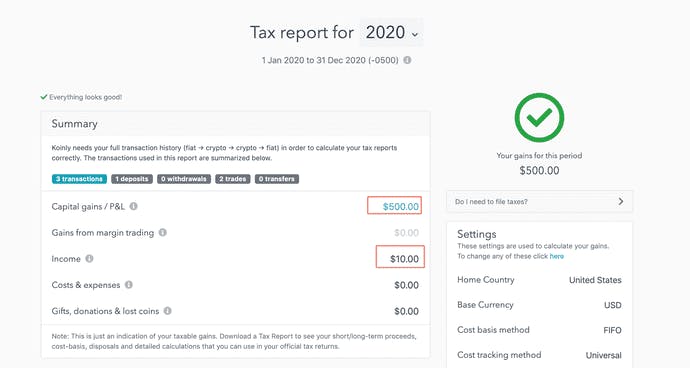

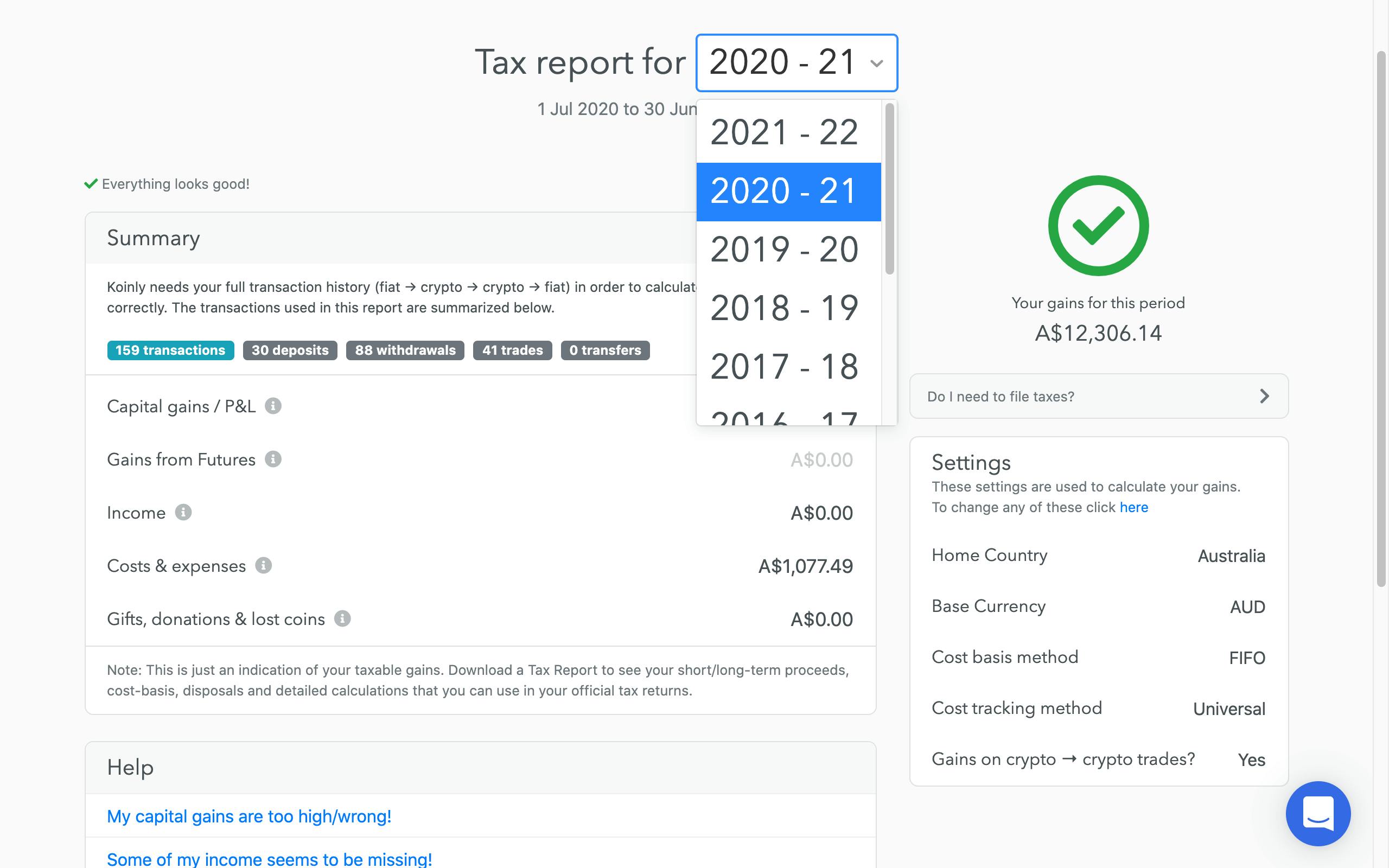

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

Guide To Declaring Crypto Taxes In Sweden

How To Report Cryptocurrency On Taxes Tokentax

How To Report Your Bitcoin And Crypto Taxes Easy With Koinly Works With Skatteverket Airlapse

Why You Want To Declare Your Cryptocurrency To Sars The Beancounter

How To Report Cryptocurrency On Taxes Tokentax

Germany Cryptocurrency Tax Guide 2021 Koinly

How Are Bitcoin And Other Crytpocurrencies Taxed Jean Galea

Taxes On Cryptocurrency In Spain How Much When How To Pay

Did You Report Your Cryptocurrency Investing In 2018

Tax On Cryptocurrency In Spain The Best Place In Eu 2021

Guide To Declaring Crypto Taxes In Sweden

Uk Cryptocurrency Tax Guide Cointracker

The Bitcoin Whales 1 000 People Who Own 40 Percent Of The Bitcoin Crypto Coins To Watch What Is Bitcoin What Is Bitcoin Mining Bitcoin

Australian Cryptocurrency Tax Guide 2021 Koinly

Do You Have To Report Cryptocurrency Gains Can You Use Aws To Mine Cryptocurrency