Black Scholes Cryptocurrency

Oct 16 2020 2 min read. The Black-Scholes model.

Optionsmile Bitcoin Options Fair Values

One of the leading financial figures is Myron Scholes who along with Fischer Black created the famous Black-Scholes model used extensively in finance to ultimately guarantee profit while hedging all risks.

Black scholes cryptocurrency. The Black-Scholes model is one of the most important concepts in modern financial theory. What is the Black-Scholes Model. Finally the article will end with closing thoughts on why the Black-Scholes model may poorly fit the crypto market and the implications this presents for the future of the quickly growing crypto derivatives market.

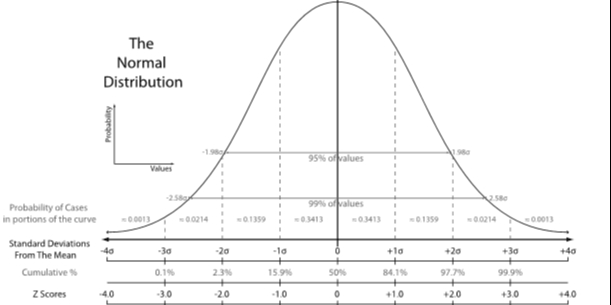

The Black-Scholes model incorporates probability theory to estimate the future value of a stock using the historical movement of the stock as a. So every trader market maker and riskportfolio manager usually needs to spend some time working around some of the assumptions implied in the Black-Scholes. The Black Scholes valuation algorithm has been the basis for the pricing of options on traditional assets since the early 1970s and remains widely used.

Pricing Bitcoin Options using Black-Scholes in R. Some of the standard limitations of the Black-Scholes model are. Following a discussion of the findings I will compare the efficacy of Black-Scholes applied to bitcoin with the SP 500.

The Black-Scholes model is one of the most commonly used formulas for pricing options contracts. The model also known as the Black-Scholes formula allows investors to determine the value of options theyre considering trading. The Black Scholes Merton model has revolutionized the role of options and other derivatives in the financial market.

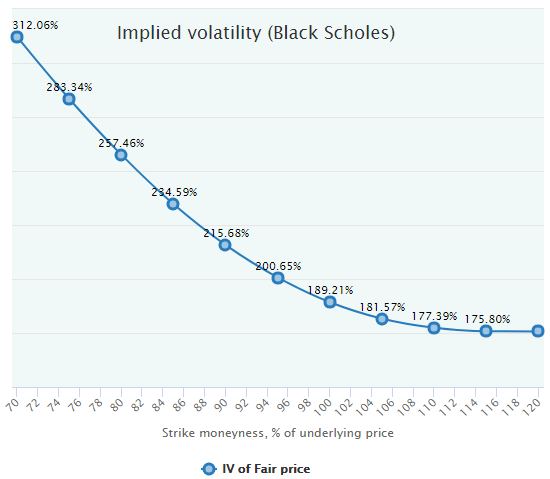

The Black-Scholes model essentially captures the risk-neutral replication of securities in a market which is said to be complete ie theres a price for every asset in every possible state of the world. It was developed in 1973 by Fischer Black Robert Merton and Myron Scholes and is still widely used today. Model implied volatility.

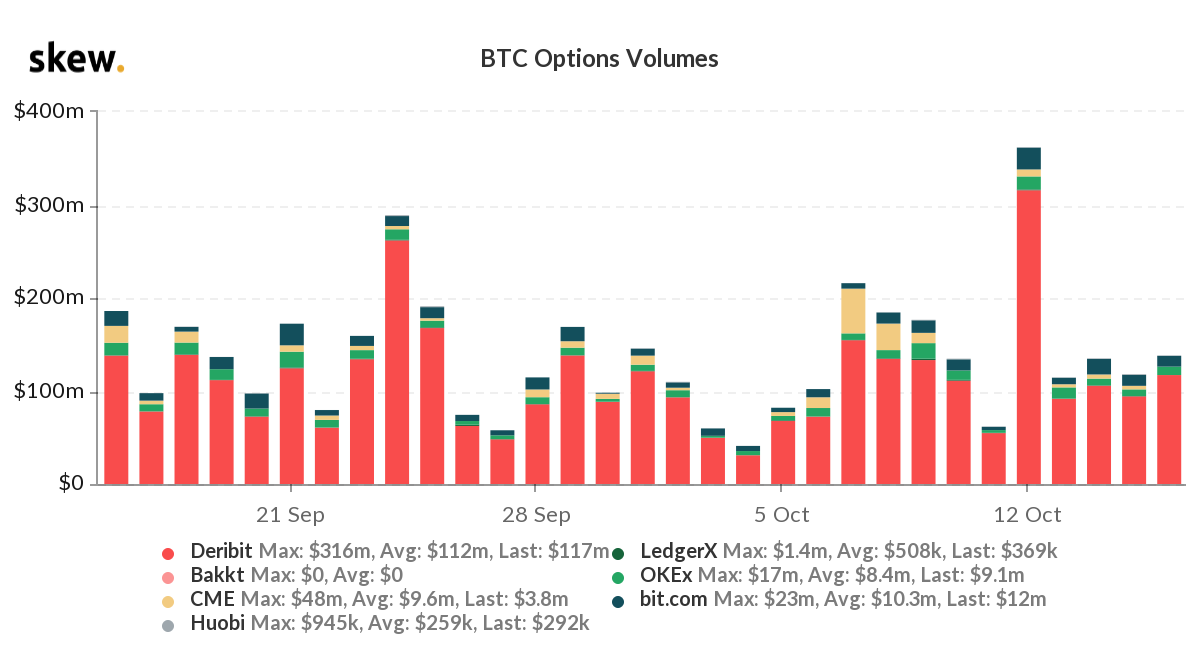

Although the Black Scholes option pricing model tends to underestimate the odds of substantial movements it does provide precise and conservative estimates. Still today the Black Scholes model plays a huge role in the world of derivatives and options trading. More than 100m of Bitcoin options are traded.

In addition risk managers need to have a view on how those implied volatilities change as cryptocurrency prices move so that they can proxy-hedge some of their. How to calculate the intrinsic value of a BTC call or put in R. Limitations of the Black-Scholes Model.

This model uses Blacks Approximation to price American Options. The cryptocurrency options market is still quite illiquid which means that Black-Scholes implied volatilities are sometimes difficult to calculate and must be estimated from limited and noisy data. Blacks Approximation is an extension of the traditional Black-Scholes model that allows the price of American Options to be approximated within the Black-Scholes Framework.

A Swedish man has been sentenced to 15 years in prison in the US. Options crypto trading cryptocurrency data-analysis derivatives black-scholes greek-calculations option-analysis Updated Sep 10 2019 Jupyter Notebook. There are limitations to the Black-Scholes model which is one of the most popular models for options pricing.

None of those may remain constant in the real world. For an investment fraud scheme involving cryptocurrency including bitcoin. The formula known widely as the Black-Scholes model is a partial differential equation that estimates the value of an option over time.

One of the leading financial figures is Myron Scholes. Assumes constant values for risk-free rate of return and volatility over the option duration. A new effort led by well-known financial figures is aiming to create a more stable cryptocurrency called Saga.

Its creators Fischer Black Myron Scholes and Robert Merton have even won a Nobel Prize for it in 1997. Black-Scholes and Crypto A new effort led by well-known financial figures is aiming to create a more stable cryptocurrency called Saga.

Analysis Is The Black Scholes Model For Pricing Traditional Financial Derivatives Also Applicable To Bitcoin Blockchain Network

Pricing Bitcoin Options Using Black Scholes In R By Cassius Cassandra Medium

Black Scholes And Crypto Usingblock

Kurtosis And Bitcoin A Quantitative Analysis Hacker Noon

:max_bytes(150000):strip_icc()/HowtoBuildValuationModelsLikeBlack-Scholes1_2-6203cb50f4334cf380010ee3812e4dcd.png)

How To Build Valuation Models Like Black Scholes

Black Scholes Indicators And Signals Tradingview

Black Scholes The Options Futures Guide

Analysis Is The Black Scholes Model For Pricing Traditional Financial Derivatives Also Applicable To Bitcoin Blockchain Network

Bitcoin Volatility Trading With Options Cryptocurrency Trading Guide

Analysis Is The Black Scholes Model For Pricing Traditional Financial Derivatives Also Applicable To Bitcoin Blockchain Network

Bopm Indicators And Signals Tradingview

Black Scholes Calibration Download Scientific Diagram

Github Davemc84 Bitcoin Payable Black Scholes Simple Bitcoin Payable Black Scholes Calculator

Understanding The Black Scholes Options Pricing Model Luckbox Magazine

Black Scholes Archives Quantlabs Net

Analysis Is The Black Scholes Model For Pricing Traditional Financial Derivatives Also Applicable To Bitcoin Blockchain Network

Analysis Is The Black Scholes Model For Pricing Traditional Financial Derivatives Also Applicable To Bitcoin Blockchain Network

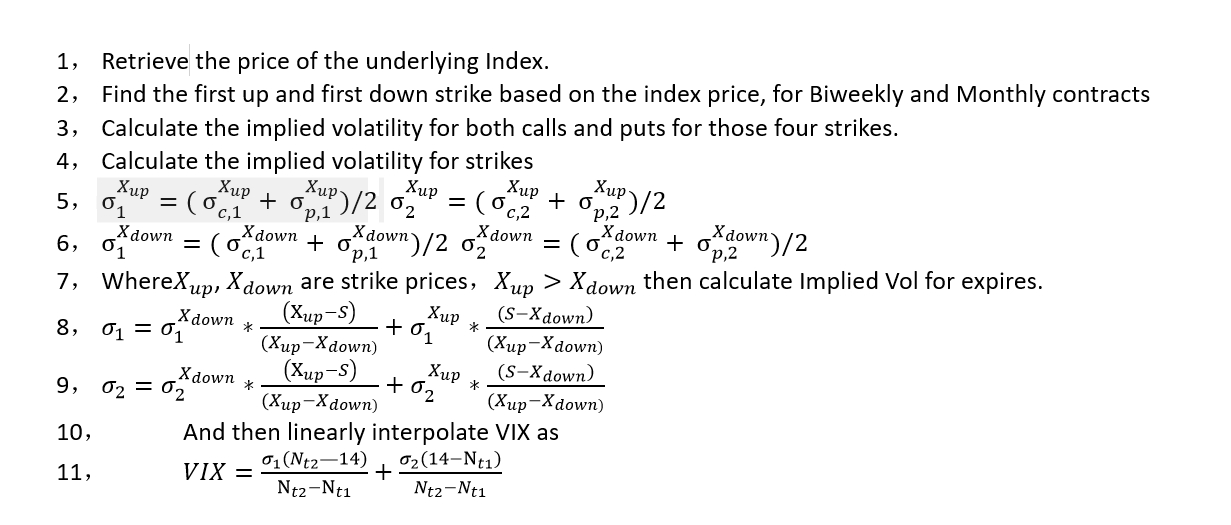

Building The First Tradable Bitcoin Volatility Index Vix Futures Hacker Noon